Stock Market Analysis

Aug 06, 2019

Stock Market Data And Analysis In Python

In this article, you will learn to get the stock market data such as price, volume and fundamental data using python packages and how to analyze it.

In backtesting your strategies or analyzing the performance, one of the first hurdles faced is getting the right stock market data and in the right format, isn't it? Don't worry.

After reading this, you will be able to:

Fetch the open, high, low, close, and volume data.

Get data at a custom frequency such as 1 minute, 7 minutes or 2 hours

Perform analysis of your portfolio

Get the earnings data, balance sheet data, cash flow statements and various key ratios such as price to earnings (PE) and price to book value (PB)

Get the futures and options data for Indian stock market

Generally, web sources are quite unstable and therefore, you will learn to get the stock market data from multiple web sources. For easy navigation, this article is divided as below.

Price Volume Daily Data

Yahoo Finance

One of the first sources from which you can get daily price-volume stock market data is Yahoo finance. You can use pandas_datareader or yfinance module to get the data.

In [ ]:

In [22]:

Out[22]:

In [7]:

Out[7]:

Date

High

Low

Open

Close

Volume

Adj Close

1997-05-15

2.500000

1.927083

2.437500

1.958333

72156000.0

1.958333

1997-05-16

1.979167

1.708333

1.968750

1.729167

14700000.0

1.729167

1997-05-19

1.770833

1.625000

1.760417

1.708333

6106800.0

1.708333

1997-05-20

1.750000

1.635417

1.729167

1.635417

5467200.0

1.635417

1997-05-21

1.645833

1.375000

1.635417

1.427083

18853200.0

1.427083

To visualize the adjusted close price data, you can use the matplotlib library and plot method as shown below.

In [9]:

Let us improve the plot by resizing, giving appropriate labels and adding grid lines for better readability.

In [10]:

Advantages

Adjusted close price stock market data is available

Most recent stock market data is available

Doesn't require API key to fetch the stock market data

Disadvantages

It is not a stable source to fetch the stock market data

If the stock market data fetching fails from yahoo finance using the pandas_datareaderthen you can use yfinance package to fetch the data.

Quandl

Quandl has many data sources to get different types of data. However, some are free and some are paid. Wiki is the free data source of Quandl to get the data of the end of the day prices of 3000+ US equities. It is curated by Quandl community and also provides information about the dividends and split. To get the stock market data, you need to first install the quandl module if it is not already installed using the pip command as shown below.

In [ ]:

You need to get your own API Key from quandl to get the stock market data using the below code. If you are facing issue in getting the API key then you can refer to this link.

After you get your key, assign the variable QUANDLAPIKEYQUANDLAPIKEY with that key. Then set the start date, end date and the ticker of the asset whose stock market data you want to fetch.

The quandl get method takes this stock market data as input and returns the open, high, low, close, volume, adjusted values and other information.

In [1]:

Out[1]:

Date

Open

High

Low

Close

Volume

Ex-Dividend

Split Ratio

Adj. Open

Adj. High

Adj. Low

Adj. Close

Adj. Volume

1997-05-16

22.38

23.75

20.50

20.75

1225000.0

0.0

1.0

1.865000

1.979167

1.708333

1.729167

14700000.0

1997-05-19

20.50

21.25

19.50

20.50

508900.0

0.0

1.0

1.708333

1.770833

1.625000

1.708333

6106800.0

1997-05-20

20.75

21.00

19.63

19.63

455600.0

0.0

1.0

1.729167

1.750000

1.635833

1.635833

5467200.0

1997-05-21

19.25

19.75

16.50

17.13

1571100.0

0.0

1.0

1.604167

1.645833

1.375000

1.427500

18853200.0

1997-05-22

17.25

17.38

15.75

16.75

981400.0

0.0

1.0

1.437500

1.448333

1.312500

1.395833

11776800.0

In [3]:

Get stock market data for multiple tickers

To get the stock market data of multiple stock tickers, you can create a list of tickers and call the quandl get method for each stock ticker.[1]

For simplicity, I have created a dataframe data to store the adjusted close price of the stocks.

In [4]:

Out[4]:

Date

AAPL

IBM

MSFT

WMT

1990-01-02

1.118093

14.138144

0.410278

4.054211

1990-01-03

1.125597

14.263656

0.412590

4.054211

1990-01-04

1.129499

14.426678

0.424702

4.033561

1990-01-05

1.133101

14.390611

0.414300

3.990541

1990-01-08

1.140605

14.480057

0.420680

4.043886

In [5]:

Advantages

It is free of cost

Has split and dividend-adjusted stock market data

Disadvantages

Only available till 27-March-2018

Intraday Data

Alpha Vantage

Alpha vantage is used to get the minute level stock market data. You need to signup on alpha vantage to get the free API key.

In [ ]:

Assign the ALPHA_VANTAGE_API_KEY, with your API Key in the below code.

In [12]:

Out[12]:

This gives information about the stock market data which is returned. The information includes the type of data returned such as open, high, low and close, the symbol or ticker of the stock, last refresh time of the data, frequency of the stock market data and the time zone.

In [13]:

Out[13]:

Date

Open

High

Low

Close

Volume

2019-07-26 09:31:00

1228.2300

1232.49

1228.0000

1230.7898

407037.0

2019-07-26 09:32:00

1230.9200

1235.13

1230.4301

1233.0000

111929.0

2019-07-26 09:33:00

1233.0000

1237.90

1232.7500

1237.9000

86564.0

2019-07-26 09:34:00

1237.4449

1241.90

1237.0000

1241.9000

105884.0

2019-07-26 09:35:00

1241.9399

1244.49

1241.3500

1243.1300

74444.0

In [19]:

Get data at a custom frequency

During strategy modelling, you are required to work with a custom frequency of stock market data such as 7 minutes or 35 minutes. This custom frequency candles are not provided by data vendors or web sources. In this case, you can use the pandas resample method to convert the stock market data to the frequency of your choice. The implementation of these is shown below where a 1-minute frequency data is converted to 10-minute frequency data.

The first step is to define the dictionary with the conversion logic. For example, to get the open value the first value will be used, to get the high value the maximum value will be used and so on.

In [ ]:

Convert the index to datetime timestamp as by default string is returned. Then call the resample method with the frequency such as

10T for 10 minutes,

D for 1 day and

M for 1 month

In [130]:

Out[130]:

Date

Open

High

Low

Close

Volume

2019-07-17 09:30:00

1150.9200

1155.5500

1150.510

1154.28

82911.0

2019-07-17 09:40:00

1154.2950

1157.8400

1154.295

1157.76

35549.0

2019-07-17 09:50:00

1157.4250

1158.4399

1155.670

1155.67

30371.0

2019-07-17 10:00:00

1155.4700

1156.0200

1153.090

1153.09

21445.0

2019-07-17 10:10:00

1153.0194

1153.4200

1151.000

1152.29

31073.0

yfinance

yfinance is another module which can be used to fetch the minute level stock market data. It returns the stock market data for the last 7 days.

In [ ]:

The yfinance module has the download method which can be used to download the stock market data. It takes the following parameters:

ticker: The name of the tickers you want the data for. If you want data for multiple tickers then separate them by spaceperiod: The number of days/month of data required. The valid frequencies are 1d, 5d, 1mo, 3mo, 6mo, 1y, 2y, 5y, 10y, ytd, maxinterval: The frequency of data. The valid intervals are 1m, 2m, 5m, 15m, 30m, 60m, 90m, 1h, 1d, 5d, 1wk, 1mo, 3mo

The below code fetches the stock market data for MSFT for the past 5 days of 1-minute frequency.

In [133]:

Out[133]:

Datetime

Open

High

Low

Close

Adj Close

Volume

2019-07-17 09:30:00-04:00

137.70

137.75

137.23

137.33

137.33

645676

2019-07-17 09:31:00-04:00

137.33

137.43

137.22

137.40

137.40

112675

2019-07-17 09:32:00-04:00

137.39

137.40

137.18

137.29

137.29

73906

2019-07-17 09:33:00-04:00

137.44

137.58

137.39

137.42

137.42

127492

2019-07-17 09:34:00-04:00

137.44

137.52

137.43

137.45

137.45

56630

Stocks Fundamental Data

We have used yfinance to get the fundamental data. The first step is to set the ticker and then call the appropriate properties to get the right stock market data.

In [ ]:

In [ ]:

Key Ratios

You can fetch the latest price to book ratio and price to earnings ratio as shown below.

In [ ]:

Revenues

In [134]:

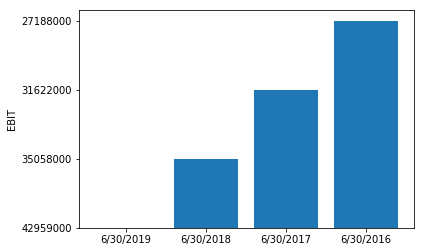

Earnings Before Interest and Taxes

In [135]:

Balance sheet, cash flows and other information

In [ ]:

Futures and Options (F&O) Data for Indian Equities

NSEpy

The nsepy package is used to get the stock market data for the futures and options for Indian stocks and indices.

Futures Data

In [15]:

Out[15]:

Date

Symbol

Expiry

Open

High

Low

Close

Last

Settle Price

Number of Contracts

Turnover

Open Interest

Change in OI

Underlying

2019-01-15

HDFC

2019-02-28

1986.70

2011.00

1982.95

2008.25

2006.20

2008.25

4810

4.796817e+09

2537500

2299500

1992.15

2019-01-16

HDFC

2019-02-28

2002.10

2010.15

1985.20

1992.15

1991.30

1992.15

2656

2.655748e+09

3783500

1246000

1975.00

2019-01-17

HDFC

2019-02-28

2003.60

2019.05

1991.60

2017.15

2013.00

2017.15

3993

4.008667e+09

5545000

1761500

NaN

2019-01-18

HDFC

2019-02-28

2018.55

2025.75

2005.00

2018.40

2017.25

2018.40

481

4.845300e+08

5637000

92000

2006.85

2019-01-21

HDFC

2019-02-28

2011.25

2031.10

1998.00

2016.55

2016.60

2016.55

1489

1.505249e+09

6258000

621000

2004.45

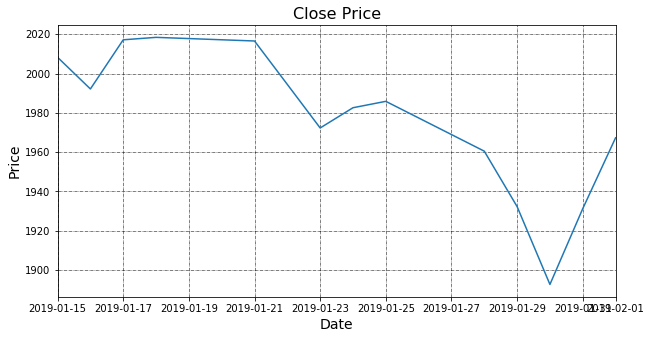

In [20]:

Options Data

In [17]:

Out[17]:

Date

Symbol

Expiry

Option Type

Strike Price

Open

High

Low

Close

Last

Settle Price

Number of Contracts

Turnover

Premium Turnover

Open Interest

Change in OI

Underlying

2019-01-15

HDFC

2019-02-28

CE

2000.0

52.70

56.00

52.70

56.0

56.0

56.0

3

3081000.0

81000.0

10000

1000

1992.15

2019-01-16

HDFC

2019-02-28

CE

2000.0

55.00

55.00

49.00

49.0

49.0

49.0

14

14358000.0

358000.0

11000

1000

1975.00

2019-01-17

HDFC

2019-02-28

CE

2000.0

59.15

64.65

51.00

61.9

61.9

61.9

27

27750000.0

750000.0

18500

7500

NaN

2019-01-18

HDFC

2019-02-28

CE

2000.0

63.00

63.00

60.00

60.0

60.0

60.0

7

7212000.0

212000.0

18500

0

2006.85

2019-01-21

HDFC

2019-02-28

CE

2000.0

62.05

69.00

62.05

62.9

62.9

62.9

6

6198000.0

198000.0

20000

1500

2004.45

In [21]:

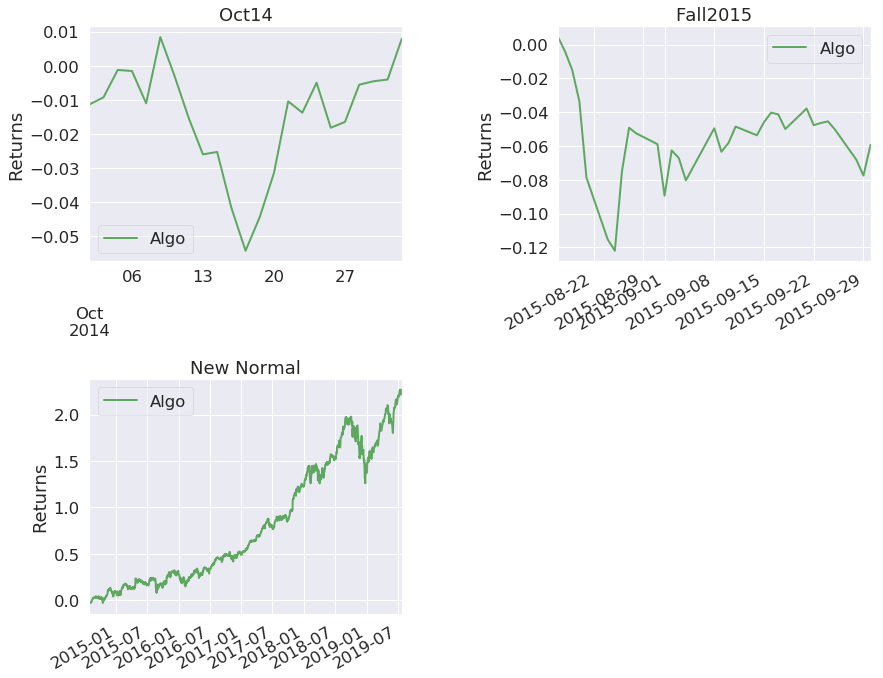

Visualization and Analysis

After you have the stock market data, the next step is to create trading strategies and analyze the performance. I have created a simple buy and hold strategy for illustration purpose with four stocks namely Apple, Amazon, Microsoft and Walmart. To analyze the performance, you can use the pyfolio tear sheet as shown below.

In [ ]:

In [ ]:

In [16]:

Out[16]:

In [21]:

Start date

2014-07-29

End date

2019-07-25

Total months

59

Backtest

Annual return

26.6%

Cumulative returns

224.4%

Annual volatility

18.2%

Sharpe ratio

1.39

Calmar ratio

1.11

Stability

0.96

Max drawdown

-24.1%

Omega ratio

1.28

Sortino ratio

2.07

Skew

0.15

Kurtosis

4.25

Tail ratio

0.94

Daily value at risk

-2.2%

Worst drawdown periods

Net drawdown in %

Peak date

Valley date

Recovery date

Duration

0

24.08

2018-10-01

2018-12-24

2019-04-17

143

1

13.15

2015-07-30

2015-08-25

2015-10-23

62

2

13.12

2015-12-07

2016-02-09

2016-04-13

93

3

9.65

2019-05-03

2019-06-03

2019-06-18

33

4

8.46

2018-03-12

2018-04-02

2018-05-10

44

Stress Events

mean

min

max

Oct14

0.04%

-1.68%

2.17%

Fall2015

-0.17%

-4.67%

5.35%

New Normal

0.10%

-4.67%

7.17%

I hope you can use the Python codes to fetch the stock market data of your favourites stocks, build the strategies and analyze it. I would appreciate if you could share your thoughts and your comments below. Python is quite essential to understand data structures, data analysis, dealing with financial data, and for generating trading signals. For traders and quants who want to learn and use Python in trading, this bundle of courses is just perfect. Disclaimer: All investments and trading in the stock market involve risk. Any decisions to place trades in the financial markets, including trading in stock or options or other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. The trading strategies or related information mentioned in this article is for informational purposes only.

Reference : https://blog.quantinsti.com/stock-market-data-analysis-python/

Last updated